The Electronic Benefits Transfer (EBT) system is a government-funded program that provides financial assistance to low-income individuals and families to purchase food. With the increasing popularity of digital payment methods, many have wondered whether Apple Pay can be used to access these benefits.

In this article, we will explore the compatibility of Apple Pay with food stamps, examining the technical limitations, alternative payment methods, potential benefits, implementation considerations, and the impact on food stamp recipients.

Apple Pay is a mobile payment and digital wallet service that allows users to make secure and convenient payments using their Apple devices. It has gained widespread acceptance among consumers and merchants alike due to its ease of use, enhanced security features, and wide availability.

Food Stamps Overview

Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are a government-funded program that provides financial assistance to low-income individuals and families to purchase food. The program aims to improve food security and nutrition among eligible households.

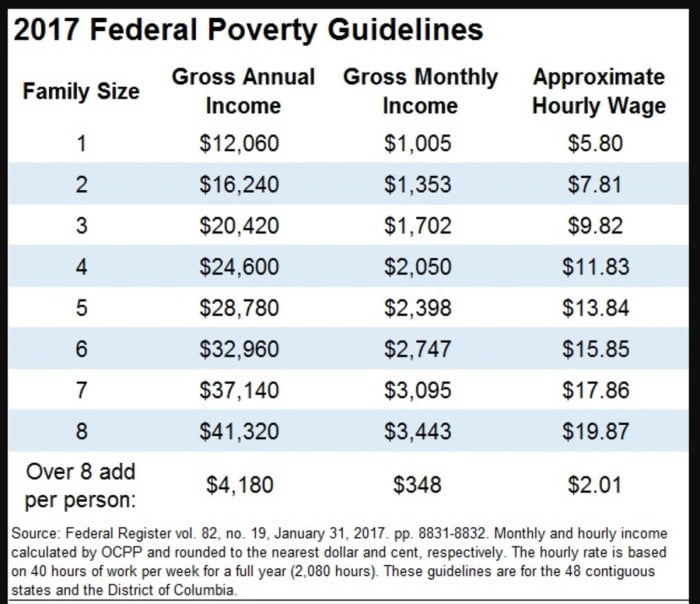

Eligibility for food stamps is based on income and household size. To qualify, individuals or families must meet specific income limits, which vary depending on the state of residence and household composition. Additionally, certain asset limits may also apply.

Application Process

To apply for food stamps, individuals can visit their local social services office or apply online through the state’s SNAP website. The application process typically involves providing proof of income, household size, and assets. Once the application is approved, eligible individuals will receive an Electronic Benefits Transfer (EBT) card, which can be used to purchase food at authorized retailers.

Apple Pay Compatibility

Currently, Apple Pay does not directly support the use of food stamps or Electronic Benefit Transfer (EBT) cards.

Technical Limitations

The main technical limitation is that Apple Pay is designed to work with debit or credit cards, which require a bank account and a valid payment processor. EBT cards, on the other hand, are government-issued prepaid cards that are not linked to a bank account.

Alternative Payment Methods

In addition to Apple Pay, several alternative payment methods can be used for food stamps. Each method offers unique features, benefits, and drawbacks.

The following table compares the most commonly used alternative payment methods:

| Method | Features | Benefits | Drawbacks |

|---|---|---|---|

| EBT Card |

|

|

|

| Mobile Payment Apps |

|

|

|

| Direct Deposit |

|

|

|

Benefits of Using Apple Pay (if applicable)

Using Apple Pay for food stamps offers several advantages that can enhance your shopping experience.

One of the key benefits is convenience. With Apple Pay, you can make contactless payments at participating stores, eliminating the need to carry cash or physical EBT cards. This simplifies the checkout process and saves time, especially when you’re in a hurry.

Enhanced Security

Apple Pay employs advanced security measures to protect your financial information. When you add your EBT card to Apple Pay, it creates a unique token that is used for transactions instead of your actual card number. This tokenization process helps prevent unauthorized access to your sensitive data, providing peace of mind when making purchases.

Implementation Considerations

Implementing Apple Pay for food stamps involves several key steps:

Partnering with a participating retailer or payment processor

Establish a relationship with an entity that supports Apple Pay and accepts food stamp payments.

Integrating with the Apple Pay system

Configure your point-of-sale (POS) system or mobile app to accept Apple Pay transactions.

Ensuring compliance with regulations

Adhere to all applicable laws and regulations governing the use of food stamps, including those related to data security and fraud prevention.

Challenges

Technical complexities

Integrating Apple Pay into existing payment systems can require technical expertise and resources.

Cost of implementation

Implementing Apple Pay may involve upfront costs and ongoing fees associated with payment processing.

Fraud concerns

Implementing strong fraud prevention measures is crucial to mitigate the risk of unauthorized transactions.

Opportunities

Enhanced customer experience

Apple Pay offers a convenient and secure payment option for customers, potentially increasing satisfaction.

Increased sales

Accepting Apple Pay can attract customers who prefer this payment method, leading to potential sales growth.

Improved efficiency

Apple Pay can streamline the checkout process, reducing wait times and improving operational efficiency.

Impact on Food Stamp Recipients

Apple Pay’s integration with food stamps has the potential to significantly impact recipients. It offers several advantages, including enhanced accessibility, convenience, and security. However, it also raises concerns regarding affordability and compatibility.

Accessibility and Convenience

Apple Pay’s mobile platform provides convenient access to food stamp benefits. Recipients can make purchases at participating retailers using their iPhone or Apple Watch, eliminating the need for physical cards or cash. This increased accessibility can be particularly beneficial for individuals with limited mobility or who live in areas with limited access to traditional grocery stores.

Affordability

While Apple Pay offers convenience, it may also present affordability challenges for some food stamp recipients. The program’s restrictions on eligible purchases remain in place when using Apple Pay, and recipients must ensure they have sufficient funds in their account before making transactions.

Additionally, some retailers may charge additional fees for using Apple Pay, which could impact the affordability of food purchases.

Security

Apple Pay employs robust security measures to protect users’ financial information. Transactions are encrypted and tokenized, reducing the risk of fraud or identity theft. This enhanced security can provide peace of mind to food stamp recipients, particularly those who may be vulnerable to financial exploitation.

Other Considerations

Other implications of Apple Pay for food stamp recipients include:

- Compatibility: Apple Pay is only available on Apple devices, which may limit accessibility for recipients who do not own or cannot afford such devices.

- Acceptance: Not all retailers accept Apple Pay, which could limit the options for food stamp recipients to make purchases.

- Privacy: Apple Pay collects data on user transactions, which may raise privacy concerns for some recipients.

Closure

In conclusion, while Apple Pay is not currently compatible with food stamps, there are several alternative payment methods available that offer varying levels of convenience, security, and accessibility. As technology continues to evolve, we may see the integration of Apple Pay with EBT in the future, providing food stamp recipients with a more seamless and secure payment experience.

Until then, the available alternative payment methods offer viable options for accessing these essential benefits.

Answers to Common Questions

Can I use my Apple Watch to access food stamps?

No, Apple Pay is not currently compatible with food stamps, and this includes using Apple Watch for payments.

What are the alternative payment methods I can use for food stamps?

Alternative payment methods for food stamps include EBT cards, mobile apps like Walmart Pay, and physical checks.

Is it safe to use my EBT card for online purchases?

Yes, EBT cards can be used for online purchases at authorized retailers that accept SNAP benefits.

How can I check my food stamp balance?

You can check your food stamp balance by calling the customer service number on the back of your EBT card, visiting the state’s EBT website, or using the mobile app provided by your state’s EBT program.