The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a government-funded program that provides food assistance to low-income individuals and families. To qualify for food stamps, applicants must meet certain eligibility criteria, including income and asset limits.

One of the pieces of information that applicants may be asked to provide is their bank account information.

This information can be used to verify the applicant’s income and assets and to ensure that they meet the eligibility criteria. In this article, we will discuss the process of verifying bank account information for food stamp eligibility, the methods used, and the consequences of providing false or inaccurate information.

Food Stamp Eligibility and Bank Account Verification

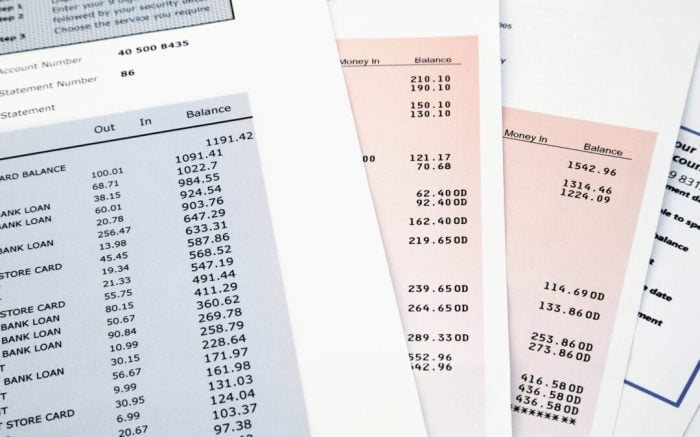

To qualify for food stamps, applicants must meet specific eligibility criteria, including income and resource limits. During the application process, applicants are required to provide information about their bank accounts, including account type, balance, and transaction history. This information is used to verify the applicant’s eligibility and determine the amount of benefits they may receive.

Bank Account Requirements

Applicants must provide information about all bank accounts they own, regardless of whether they are active or inactive. The bank account information required includes:

- Account type (checking, savings, etc.)

- Account number

- Bank name

- Account balance

- Transaction history

The applicant’s bank account balance and transaction history are used to determine their financial resources and whether they meet the eligibility criteria for food stamps. Applicants with high account balances or frequent large deposits may be ineligible for benefits.

Methods of Bank Account Verification

Verifying bank account information is a crucial step in determining food stamp eligibility. Various methods are employed to ensure the accuracy and validity of the provided information.

Direct Access

Direct access involves the government or authorized agencies directly accessing the applicant’s bank account records with their consent. This method provides the most accurate and reliable verification, as it eliminates the potential for errors or misrepresentation.

Advantages:

- High accuracy and reliability

- Reduces the risk of fraud or errors

Disadvantages:

- Requires consent from the applicant

- May raise privacy concerns

Third-Party Verification

Third-party verification involves obtaining bank account information from a trusted third party, such as a financial institution or a non-profit organization. This method relies on the credibility of the third party to provide accurate and up-to-date information.

Advantages:

- Can be used when direct access is not feasible

- Reduces the burden on applicants

Disadvantages:

- Potential for errors or delays in information retrieval

- May not be as accurate as direct access

Self-Reporting

Self-reporting requires applicants to provide their bank account information directly to the government or authorized agencies. This method relies on the honesty and accuracy of the applicant’s reporting.

Advantages:

- Simple and convenient for applicants

- Does not require third-party involvement

Disadvantages:

- Higher risk of fraud or errors

- May not be reliable for applicants with complex financial situations

Exceptions and Special Circumstances

There are a few exceptions and special circumstances that may affect the requirement to check bank accounts for food stamp eligibility. These exceptions are typically based on factors such as age, disability, or homelessness.

For individuals who are elderly, disabled, or homeless, there may be alternative methods of verifying income and assets. For example, these individuals may be able to provide documentation from a social worker or other service provider to verify their income and assets.

Elderly or Disabled Individuals

For elderly or disabled individuals, they may be exempt from the bank account verification requirement if they meet certain criteria. For example, they may be receiving Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), which are considered exempt income sources.

Homeless Individuals

For homeless individuals, they may be exempt from the bank account verification requirement if they do not have a permanent address. In such cases, they may be able to provide documentation from a homeless shelter or other service provider to verify their income and assets.

Consequences of False or Inaccurate Bank Account Information

Providing false or inaccurate bank account information during the food stamp eligibility verification process can have severe consequences. It can lead to the denial of benefits, overpayments, and even criminal charges.

Penalties for False or Inaccurate Information

Individuals who intentionally provide false or inaccurate bank account information may face the following penalties:

-

-*Denial of Benefits

The food stamp application may be denied, and benefits may be withheld until accurate information is provided.

-*Overpayments

If benefits are mistakenly issued based on false information, the recipient may be required to repay the overpaid amount.

-*Criminal Charges

In some cases, providing false information to obtain government benefits may constitute fraud, which can lead to criminal prosecution and penalties, including fines or imprisonment.

Therefore, it is crucial to provide accurate and truthful bank account information during the food stamp eligibility verification process to avoid potential consequences and ensure the integrity of the program.

Privacy and Security Concerns

Understanding privacy and security concerns is crucial when verifying bank account information for food stamp eligibility. Protecting the confidentiality and security of personal financial information is paramount.

Measures to Protect Privacy and Security

Several measures are implemented to safeguard bank account information:

- Encryption: Sensitive information is encrypted during transmission and storage, preventing unauthorized access.

- Secure Systems: Bank account verification systems are designed with robust security protocols and firewalls to protect against cyber threats.

- Limited Access: Access to bank account information is restricted to authorized personnel only.

- Compliance with Regulations: Verification processes adhere to strict data protection regulations and industry standards.

- Privacy Policies: Clear privacy policies inform individuals about how their information is used and protected.

Last Recap

In conclusion, the verification of bank account information is an important part of the food stamp eligibility process. It helps to ensure that the program is being used by those who are truly in need. If you are applying for food stamps, be sure to provide accurate and complete information about your bank account.

Failure to do so could result in delays or denial of benefits.

Common Queries

Does the food stamp program check my bank account balance?

Yes, the food stamp program may check your bank account balance as part of the eligibility verification process. This is to ensure that you meet the asset limits for the program.

What types of bank accounts can I use for food stamps?

You can use any type of bank account for food stamps, including checking, savings, and prepaid cards.

What if I don’t have a bank account?

If you don’t have a bank account, you can still apply for food stamps. You will need to provide proof of your income and assets in another way, such as through pay stubs or bank statements.

What are the consequences of providing false or inaccurate bank account information?

Providing false or inaccurate bank account information can result in delays or denial of benefits. You may also be subject to penalties, such as overpayments or criminal charges.