Inheriting assets can be a life-changing event, but it’s important to understand how it may impact your eligibility for government assistance programs like food stamps. This article will provide a comprehensive overview of the rules and regulations surrounding inheritance reporting for food stamps, helping you navigate this complex topic.

Whether or not you need to report an inheritance depends on several factors, including the value of the inheritance, the type of assets inherited, and your current food stamp benefits. Understanding these factors will ensure you comply with program requirements and avoid any potential consequences.

Inheritance and Food Stamps

In the United States, food stamps are a form of government assistance that helps low-income individuals and families purchase food. If you receive food stamps and inherit money or property, you must report the inheritance to your local food stamp office.

The rules and regulations regarding inheritance and food stamps vary from state to state. However, in general, you must report any inheritance that you receive that is worth more than $2,000. You must also report any inheritance that you receive that increases your total assets to more than $5,000.

Consequences of Not Reporting Inheritance

If you fail to report an inheritance to your local food stamp office, you may be subject to penalties. These penalties may include having your food stamp benefits reduced or terminated.

In addition, you may be required to pay back any food stamp benefits that you received while you were ineligible. You may also be subject to criminal prosecution.

Exempt Inheritances

Inheritances that do not count as income for food stamps include:

- Inherited property: Homes, land, and other real estate inherited are generally not counted as income for food stamps. However, any income generated from the property, such as rent or dividends, is considered income.

- Inherited personal property: Personal belongings, such as furniture, jewelry, or vehicles, are not considered income for food stamps.

- Inherited money: Money inherited in a lump sum is not counted as income for food stamps. However, interest earned on the money is considered income.

These inheritances are exempt because they are not considered income. They do not increase the recipient’s financial resources in a way that would make them ineligible for food stamps.

Inherited Property

Inherited property is not considered income for food stamps because it is not a liquid asset. It cannot be easily converted into cash, and it does not generate income on its own. However, if the recipient sells or rents out the property, the proceeds from the sale or rent are considered income.

Inherited Personal Property

Inherited personal property is not considered income for food stamps because it is not a valuable asset. It does not have a significant monetary value, and it does not generate income.

Inherited Money

Inherited money is not considered income for food stamps because it is a one-time payment. It does not increase the recipient’s financial resources in a way that would make them ineligible for food stamps. However, interest earned on the money is considered income.

Reporting Inheritances

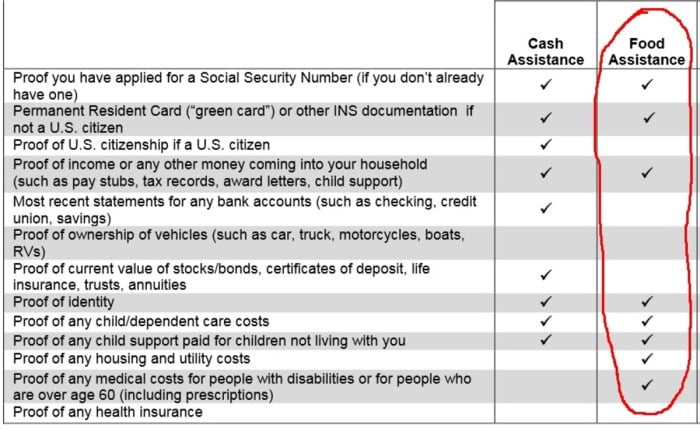

Inheritances received by individuals receiving food stamp benefits must be reported to the food stamp program. The procedures for reporting inheritances vary from state to state, but generally, the following steps must be followed:

- Contact the local food stamp office within 10 days of receiving the inheritance.

- Provide the food stamp office with documentation of the inheritance, such as a bank statement or a letter from the executor of the estate.

- The food stamp office will review the documentation and determine if the inheritance affects the individual’s eligibility for food stamps.

The timeframes for reporting inheritances also vary from state to state. In general, individuals must report inheritances within 10 days of receiving them. However, some states may allow individuals to report inheritances within a longer timeframe, such as 30 days or 60 days.

Individuals should contact their local food stamp office to find out the specific timeframes for reporting inheritances in their state.

Impact of Inheritances on Food Stamp Benefits

Inheritances can significantly impact an individual’s eligibility for food stamps. Depending on the value of the inheritance and the recipient’s financial situation, inheritances can affect food stamp benefits in various ways.Inheritances can disqualify individuals from food stamps if the value of the inheritance exceeds certain asset limits.

Asset limits vary depending on household size and composition. For instance, in 2023, a single individual can have up to $2,500 in countable assets, while a household of four can have up to $4,000. Inheritances that push an individual’s assets above these limits can result in disqualification from food stamps.

Other Considerations

Inheriting property can have a significant impact on your eligibility for other government benefits, such as Medicaid, Supplemental Security Income (SSI), and Social Security Disability Insurance (SSDI). It’s crucial to understand how inheritances affect these programs to avoid any potential loss of benefits.

Legal Advice

When inheriting property, it’s essential to seek legal advice from an experienced attorney. They can guide you through the legal complexities of inheritance and help you make informed decisions about how to handle your inheritance. Legal counsel can ensure that you understand your rights and responsibilities as an heir and advise you on how to minimize the impact of inheritance on your government benefits.

Final Thoughts

In conclusion, reporting inheritance accurately and promptly is crucial for maintaining eligibility for food stamps. Failure to do so can result in overpayments, disqualification, or even legal penalties. By understanding the rules and procedures Artikeld in this article, you can ensure that your inheritance does not negatively impact your access to essential food assistance.

Q&A

Do I need to report all inheritances to food stamps?

No, not all inheritances need to be reported. Inheritances that are exempt from reporting include those that are used to pay for funeral expenses, those that are used to purchase a home or vehicle, and those that are valued below a certain threshold.

What is the time frame for reporting an inheritance to food stamps?

You must report an inheritance to food stamps within 10 days of receiving it. Failure to do so may result in a reduction or termination of benefits.

How can an inheritance affect my food stamp benefits?

Inheritances can affect your food stamp benefits in several ways. Inheritances that exceed certain asset limits may disqualify you from receiving food stamps. Additionally, inheritances that are used to purchase non-exempt assets may reduce your monthly benefit amount.