In the United States, Supplemental Security Income (SSI) and the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, are two essential safety net programs that provide financial assistance to low-income individuals and families. Understanding the relationship between these programs is crucial for maximizing benefits and ensuring access to vital resources.

This article delves into the complexities of SSI and SNAP eligibility, exploring whether SSI counts as income for food stamp purposes and examining the potential impact on benefits.

SSI is a federal program that provides monthly payments to disabled adults and children, as well as elderly individuals with limited income and resources. SNAP, on the other hand, is a nutrition assistance program that helps low-income households purchase food.

Both programs have specific eligibility criteria and benefit calculation methods, which can interact in complex ways.

Supplemental Security Income (SSI)

Supplemental Security Income (SSI) is a federal program that provides financial assistance to individuals with disabilities, blindness, or who are over 65 years of age and have limited income and resources.

To be eligible for SSI, individuals must meet certain criteria, including:

- Have a disability, blindness, or be over 65 years of age.

- Have limited income and resources.

- Be a U.S. citizen or a qualified non-citizen.

- Reside in one of the 50 states, the District of Columbia, or the Northern Mariana Islands.

SSI payments are calculated based on the individual’s income and resources. The basic SSI payment amount is adjusted each year to keep pace with inflation. In 2023, the maximum SSI payment for an individual is $914 per month, and the maximum SSI payment for a couple is $1,371 per month.

Food Stamps (SNAP)

The Supplemental Nutrition Assistance Program (SNAP), commonly known as Food Stamps, is a federally funded program that provides nutrition assistance to low-income individuals and families. Its primary purpose is to improve the nutritional status of eligible households by providing them with supplemental food benefits to purchase groceries.

Eligibility Criteria for SNAP

To be eligible for SNAP, individuals or households must meet certain criteria, including:

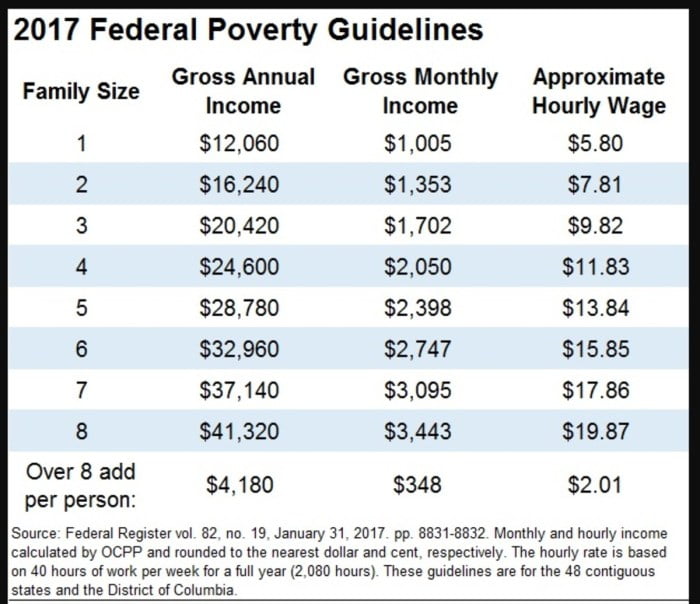

- Income limits: Household income must be below a certain threshold, which varies depending on household size and composition.

- Resource limits: Households must have limited financial resources, such as cash, bank accounts, and investments.

- Work requirements: Able-bodied adults between the ages of 18 and 59 must meet certain work or training requirements, unless they qualify for an exemption.

Calculation of SNAP Benefits

The amount of SNAP benefits that a household receives is calculated based on the following factors:

- Household size: The larger the household, the higher the benefit amount.

- Income: Households with lower incomes receive higher benefit amounts.

- Deductions: Certain deductions, such as shelter expenses and child care costs, are taken into account when calculating the benefit amount.

SNAP benefit amounts are adjusted annually based on the cost of living and other factors.

SSI and SNAP Eligibility

Supplemental Security Income (SSI) is a federal program that provides monthly cash payments to people with disabilities or who are over the age of 65 and have limited income and resources. The Food Stamp Program (SNAP) is a federal program that provides food assistance to low-income individuals and families.SSI

counts as income for SNAP purposes. However, there is a special rule for SSI recipients who are considered “categorically eligible” for SNAP. Categorically eligible means that you do not have to meet the usual SNAP income and resource limits to qualify for benefits.

To be categorically eligible for SNAP, you must receive SSI and meet one of the following criteria:* You are age 60 or older.

- You are disabled.

- You are pregnant.

- You have a child under the age of 6.

If you are categorically eligible for SNAP, your SSI income will not count against you when determining your SNAP eligibility. However, if you are not categorically eligible for SNAP, your SSI income will count as income and may affect your SNAP eligibility and benefit amount.For

example, if you are not categorically eligible for SNAP and you receive $800 in SSI per month, your SSI income will count as $600 of income for SNAP purposes. This means that you will have to meet the SNAP income limit of $1,500 per month for a household of one person in order to qualify for SNAP benefits.

If your income is over the SNAP income limit, you will not be eligible for SNAP benefits.

Impact of SSI on SNAP Benefits

SSI payments can impact the amount of SNAP benefits received. This is because SSI is considered countable income for SNAP purposes. Countable income is any income that is counted when determining a household’s eligibility for SNAP and the amount of benefits they will receive.

SSI and SNAP Eligibility

In general, SSI recipients are eligible for SNAP benefits if they meet the other eligibility requirements, such as income and resource limits. However, SSI payments will be counted as income when determining a household’s SNAP eligibility and benefit amount.

SSI and SNAP Benefit Calculations

The amount of SNAP benefits that a household receives is based on their gross income, which includes SSI payments. The gross income is then multiplied by a percentage (called the SNAP benefit percentage) to determine the household’s SNAP benefit amount.

For example, a household with a gross income of $1,000 per month, including $500 in SSI payments, would have a SNAP benefit percentage of 30%. This means that the household would receive $300 in SNAP benefits per month.

SSI and SNAP Deductions

In some cases, SSI recipients may be eligible for deductions from their SSI income when calculating their SNAP benefits. These deductions include:

- The standard deduction

- The earned income deduction

- The dependent care deduction

These deductions can reduce the amount of SSI income that is counted when determining a household’s SNAP benefits. This can result in higher SNAP benefits for SSI recipients.

Additional Considerations

Determining SNAP eligibility for SSI recipients involves several additional factors beyond income and household size. These factors can impact the amount of SNAP benefits received or even determine eligibility.

Non-countable Income

Some types of income are not counted against the SNAP income limit. These include:

- SSI benefits

- General Assistance (GA)

- Child support payments

- Foster care payments

Deductions

Certain expenses can be subtracted from the gross income to calculate the net income used for SNAP eligibility. Deductible expenses include:

- Standard deduction

- Dependent care expenses

- Medical expenses

- Child support payments made to non-household members

Changes to Rules and Regulations

The rules and regulations governing SNAP eligibility are subject to change. It’s important for SSI recipients to stay informed about any updates or modifications that may affect their benefits.

Resources and Support

Individuals seeking SNAP benefits can access various resources and support services:

- Local SNAP offices

- Nonprofit organizations

- Government websites and hotlines

- Community outreach programs

These resources provide guidance, assistance with applications, and information on eligibility requirements and benefit amounts.

Conclusion

In conclusion, the relationship between SSI and SNAP eligibility is multifaceted, with SSI payments potentially affecting SNAP benefits in various ways. Understanding the rules and regulations governing this interaction is essential for individuals seeking to maximize their access to these vital programs.

By carefully considering the information presented in this article, SSI recipients can make informed decisions about their SNAP eligibility and ensure they receive the support they need to meet their nutritional needs.

FAQ Section

Does SSI count as income for SNAP purposes?

Yes, SSI payments are considered income when determining SNAP eligibility. However, SSI recipients may still be eligible for SNAP benefits if their total income falls below the SNAP income limits.

How does SSI affect SNAP benefits?

SSI payments can reduce SNAP benefits because they increase the recipient’s total income. The amount of the reduction depends on the SSI payment amount and the SNAP income limits.

Are there any exceptions to the rule that SSI counts as income for SNAP?

Yes, there are some exceptions, such as when the SSI recipient is a child under 18 or a student under 22. In these cases, SSI payments may not affect SNAP eligibility.