The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides vital nutritional assistance to low-income individuals and families in the United States. To qualify for SNAP benefits, applicants must meet specific income eligibility guidelines. Understanding how to calculate your income for food stamps is crucial to determine your eligibility and maximize your benefits.

This guide will provide a comprehensive overview of the income calculation process for food stamps. We will cover the income eligibility guidelines, explain how to calculate gross and net income, discuss special considerations for self-employed individuals and those with irregular income, and provide valuable resources to assist you throughout the application process.

Income Eligibility Guidelines

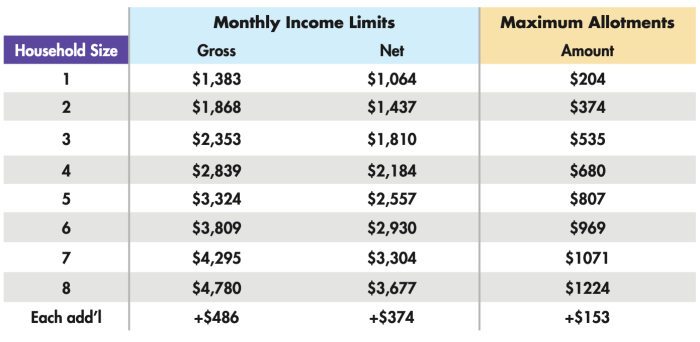

To qualify for food stamps, households must meet specific income eligibility guidelines. These guidelines are based on the household’s gross monthly income and household size.

Gross monthly income includes all income received from work, Social Security, Supplemental Security Income (SSI), unemployment, child support, and other sources.

Income That Counts

Income that counts towards the eligibility calculation includes:

- Wages, salaries, tips, and commissions

- Net income from self-employment

- Social Security benefits

- Supplemental Security Income (SSI)

- Unemployment benefits

- Child support

Income That Doesn’t Count

Income that does not count towards the eligibility calculation includes:

- Temporary Assistance for Needy Families (TANF)

- Supplemental Nutrition Assistance Program (SNAP)

- Women, Infant, and Children (WIC)

- Housing assistance

- Educational assistance

Calculating Gross Income

Calculating gross income for food stamps involves tallying up all sources of income before deducting any expenses or taxes. This includes earned income, such as wages, salaries, and self-employment income, as well as unearned income, such as Social Security benefits, pension payments, and dividends.

Adding Up All Sources of Income

To calculate gross income, add up all sources of income from the following categories:

- Earned Income: Wages, salaries, tips, commissions, and self-employment income.

- Unearned Income: Social Security benefits, Supplemental Security Income (SSI), pension payments, dividends, interest, and unemployment benefits.

Deductions from Gross Income

Certain deductions can be made from gross income before determining eligibility for food stamps. These deductions include:

- Earned Income Tax Credit (EITC)

- Child and Dependent Care Expenses

- Standard Deduction

The amount of these deductions varies depending on individual circumstances.

Calculating Net Income

Calculating net income is essential for determining your eligibility for food stamps. It involves subtracting specific deductions from your gross income. By understanding the formula and allowable deductions, you can accurately calculate your net income and assess your eligibility.

Deductions from Gross Income

The following deductions can be subtracted from gross income to calculate net income:

- Standard deduction: A fixed amount that varies based on filing status.

- Personal exemption: A specific amount for each taxpayer and dependent.

- Itemized deductions: Expenses that exceed the standard deduction, such as mortgage interest, charitable contributions, and medical expenses.

- Student loan interest deduction: Interest paid on qualified student loans.

- IRA contributions: Contributions made to traditional or Roth IRAs.

- 401(k) contributions: Contributions made to employer-sponsored retirement plans.

- Self-employment taxes: Taxes paid by self-employed individuals.

- Alimony payments: Payments made to a former spouse.

Determining Eligibility

Once you have calculated your net income, compare it to the Income Eligibility Guidelines (IEG) set by the USDA. If your net income falls below the IEG for your household size and location, you may be eligible for food stamps.

Resources and Assistance

Calculating income for food stamps can be a complex process, but there are many resources available to help individuals and families.Local food stamp offices provide free assistance with the application process, including help with calculating income. These offices can also provide information about other assistance programs that may be available, such as SNAP (Supplemental Nutrition Assistance Program) and WIC (Women, Infants, and Children).The

following organizations also provide free or low-cost assistance with calculating income for food stamps:

- National Hunger Hotline: 1-866-3-HUNGRY

- Feeding America: https://www.feedingamerica.org

- United Way: https://www.unitedway.org

- Legal Aid Society: https://www.las.org

These organizations can provide information about food stamp eligibility, help with the application process, and represent individuals in appeals if necessary.

Closing Summary

Calculating your income for food stamps may seem daunting, but by following the steps Artikeld in this guide, you can ensure an accurate assessment of your eligibility. Remember, understanding your income and expenses is essential for making informed decisions about your financial well-being.

If you have any further questions or require assistance, do not hesitate to reach out to the resources provided. Together, we can navigate the food stamp application process and access the nutritional support you need.

Helpful Answers

Can income from a part-time job count towards my food stamp eligibility?

Yes, any income you receive from employment, including part-time work, is counted towards your food stamp eligibility.

How do I calculate my net income if I am self-employed?

To calculate your net income as a self-employed individual, subtract allowable business expenses from your gross income.

What if my income fluctuates from month to month?

If your income varies significantly, you may be eligible for a special calculation method called “averaging” to determine your eligibility.