Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to purchase food. To qualify for food stamps in Georgia, you must meet certain income and asset requirements. This article will provide an overview of the income eligibility guidelines for food stamps in Georgia, including gross and net income calculations, household size and composition, assets and resources, and the application process.

The income limits for food stamps are based on the federal poverty level. For a household of one person, the gross income limit is 130% of the poverty level, which is $1,794 per month. For a household of two people, the gross income limit is 160% of the poverty level, which is $2,246 per month.

For each additional person in the household, the gross income limit increases by 5%. Net income is calculated by subtracting certain deductions from gross income, such as taxes, child support payments, and certain medical expenses.

Income Eligibility Guidelines

The income limits for food stamp eligibility in Georgia are determined by your gross and net income. Gross income is your total income before any deductions, while net income is your income after deductions. The following deductions are allowed when calculating your net income:

- Standard deduction

- Dependent care expenses

- Child support payments

- Earned income tax credit

Once your net income is calculated, it is compared to the income limits for your household size. If your net income is below the limit, you may be eligible for food stamps.

Gross and Net Income

Gross income includes all income from all sources, including:

- Wages

- Salaries

- Tips

- Commissions

- Bonuses

- Self-employment income

- Social Security benefits

- Unemployment benefits

- Workers’ compensation benefits

- Pensions

- Annuities

- Alimony

- Child support

Net income is your gross income minus the following deductions:

- Standard deduction

- Dependent care expenses

- Child support payments

- Earned income tax credit

Deductions

The standard deduction is a fixed amount that is deducted from your gross income. The amount of the standard deduction varies depending on your filing status and the number of dependents you claim.Dependent care expenses are expenses that you pay for the care of a child or disabled dependent so that you can work or attend school.

These expenses can include:

- Daycare

- Babysitting

- After-school care

- Summer camp

Child support payments are payments that you make to support a child who does not live with you.The earned income tax credit is a tax credit for low- and moderate-income working individuals and families. The amount of the credit varies depending on your income and the number of children you have.

Household Size and Composition

Household size and composition play a crucial role in determining income eligibility for food stamps in Georgia. Larger households and those with dependents or individuals with disabilities may have higher income limits.

The income limits are based on the number of people in the household and their relationship to the applicant. For example, a household with one person has a lower income limit than a household with two or more people.

Special Considerations

Households with dependents or individuals with disabilities may have special considerations when it comes to income eligibility. For example, households with children under the age of 18 or elderly or disabled members may have higher income limits.

Assets and Resources

Households must meet certain asset limits to be eligible for food stamps in Georgia. Assets are anything you own that has value, such as cash, bank accounts, stocks, bonds, and real estate. Resources are assets that can be easily converted into cash, such as vehicles and other personal property.

The asset limit for food stamps in Georgia is $2,750 for households with one or two members. For households with three or more members, the asset limit is $4,000. However, certain assets are not counted, such as your home, one vehicle, and personal belongings.

Asset Value Calculation

The value of your assets is calculated by subtracting any liens or encumbrances from the fair market value of the asset. For example, if you have a car worth $10,000 and you owe $5,000 on the loan, the value of the car for food stamp purposes would be $5,000.

Asset Limit Impact on Food Stamp

If your household’s assets exceed the limit, you may still be eligible for food stamps if you meet certain other criteria, such as being elderly or disabled. However, your food stamp benefits may be reduced.

Application Process

Applying for food stamps in Georgia is a straightforward process. You can apply online, by mail, or in person at your local Department of Family and Children Services (DFCS) office.

To apply online, visit the Georgia DFCS website at https://dfcs.georgia.gov/food-nutrition-assistance-snap . You will need to create an account and provide your personal information, household income, and assets. You can also upload any required documentation.

To apply by mail, download the application form from the Georgia DFCS website or pick one up at your local DFCS office. Fill out the form completely and mail it to the address provided on the form.

To apply in person, visit your local DFCS office. You will need to bring proof of identity, income, and assets. A DFCS representative will help you complete the application.

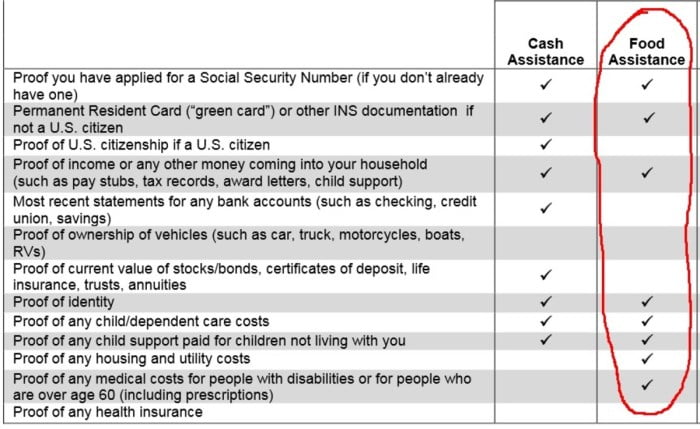

Required Documentation

When you apply for food stamps, you will need to provide proof of your identity, income, and assets. Acceptable forms of identification include a driver’s license, state ID card, or passport. Acceptable forms of income verification include pay stubs, bank statements, or a letter from your employer.

Acceptable forms of asset verification include bank statements, investment statements, or a deed to your home.

Benefits and Allowances

Food stamps in Georgia provide various benefits and allowances to eligible households. The primary benefit is a monthly allotment of funds that can be used to purchase eligible food items at authorized retailers. The allotment amount is determined based on household size and income.

Monthly Allotment Amounts

The monthly allotment amounts for food stamps in Georgia are calculated based on the Thrifty Food Plan (TFP), a measure of the cost of a nutritionally adequate diet. The TFP is adjusted annually to reflect changes in food prices. The allotment amounts are as follows:

- 1 person: $281

- 2 people: $459

- 3 people: $658

- 4 people: $835

- 5 people: $992

- 6 people: $1,149

- 7 people: $1,288

- 8 people: $1,427

- For each additional person: $139

Additional Allowances and Supplements

In addition to the basic monthly allotment, certain households may qualify for additional allowances or supplements. These include:

- Standard Utility Allowance (SUA): A monthly allowance to help cover the cost of utilities (electricity, gas, water, and sewer) for households with elderly or disabled members.

- Shelter Deduction: A deduction from gross income for households with high housing costs.

- Medical Expense Deduction: A deduction from gross income for households with high medical expenses.

- Child Support Deduction: A deduction from gross income for households receiving child support.

These allowances and deductions can help reduce the household’s net income and increase their eligibility for food stamps.

Exemptions and Exceptions

In Georgia, certain exemptions and exceptions may apply to the standard income and asset limits for food stamp eligibility. These exemptions allow individuals or households who exceed the limits to still qualify for assistance.

Medical Expenses

Individuals with high medical expenses may be eligible for a deduction from their countable income. To qualify, the medical expenses must be ongoing and exceed $35 per month. Documentation of the expenses, such as receipts or medical bills, is required.

Earned Income Disregard

Households with earned income (from work) may qualify for a disregard of a portion of their earnings. This disregard can significantly increase the amount of income that is not counted against the income limit. To qualify, the household must meet certain criteria, such as having a child under 18 or a disabled member.

Shelter Costs

Households with high shelter costs (rent or mortgage) may be eligible for a deduction from their countable income. The deduction is based on the actual shelter costs and the number of people in the household. Documentation of the shelter costs, such as a lease or utility bills, is required.

Final Thoughts

In addition to income, you must also meet certain asset limits to qualify for food stamps. Countable assets include cash, bank accounts, stocks, and bonds. Non-countable assets include your home, one vehicle, and certain retirement accounts. The asset limit for food stamps in Georgia is $2,250 for a household of one person and $3,500 for a household of two or more people.

If you meet the income and asset requirements, you can apply for food stamps online, by mail, or in person at your local Department of Family and Children Services (DFCS) office. The application process typically takes 30 days, and you will need to provide proof of income, assets, and identity.

Helpful Answers

What is the gross income limit for food stamps in Georgia for a household of four?

The gross income limit for food stamps in Georgia for a household of four is $2,892 per month.

What deductions can I subtract from my gross income to calculate my net income?

You can subtract taxes, child support payments, and certain medical expenses from your gross income to calculate your net income.

What is the asset limit for food stamps in Georgia for a household of two?

The asset limit for food stamps in Georgia for a household of two is $3,500.

How long does it typically take to process a food stamp application?

It typically takes 30 days to process a food stamp application.