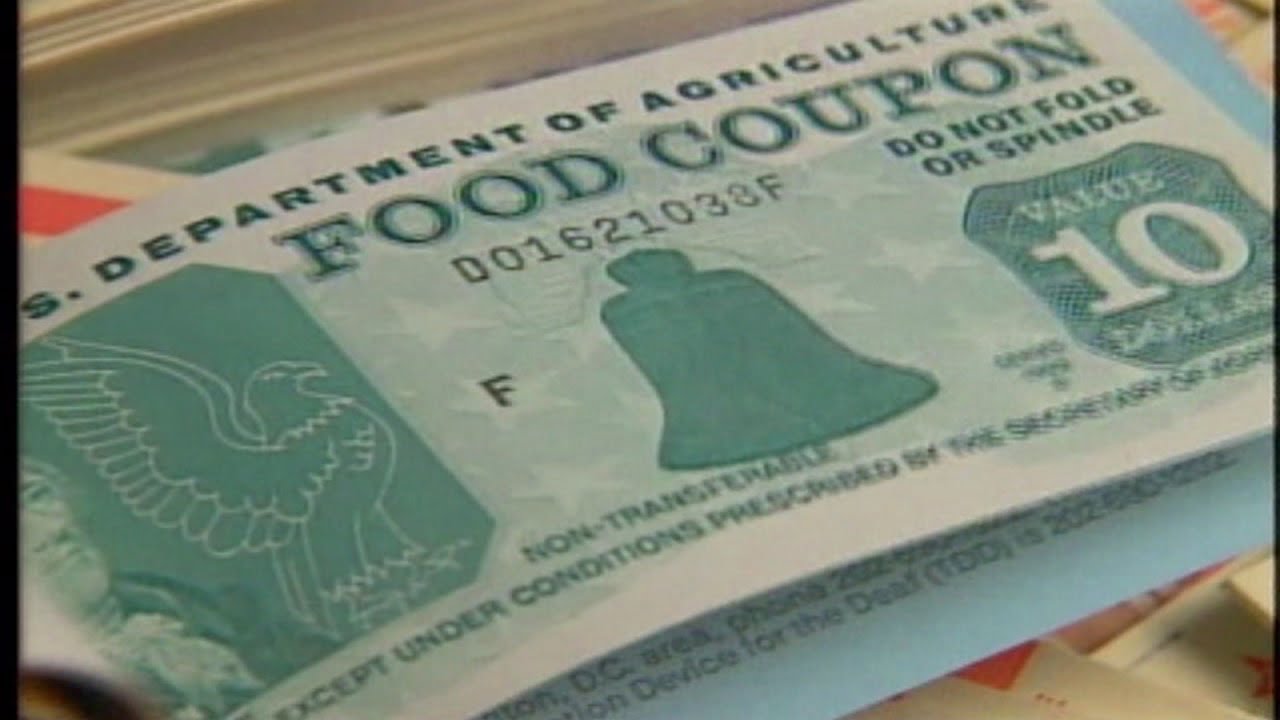

Food stamps, now known as the Supplemental Nutrition Assistance Program (SNAP), provide crucial support to millions of Americans struggling with food insecurity. However, understanding the eligibility criteria and benefit calculations can be complex, leaving many wondering why they may be receiving a seemingly low amount.

This comprehensive guide aims to clarify the factors that determine SNAP benefits, addressing the common question: “Why am I only getting $20 in food stamps?”

SNAP benefits vary based on several factors, including income, household size, deductions, and state regulations. This guide will delve into each of these aspects, providing clear explanations and examples to help you understand how your benefits are calculated.

Income and Resources

Eligibility for food stamps is determined by both income and resources. Income includes wages, salaries, self-employment income, and certain other forms of income. Resources include cash, bank accounts, stocks, bonds, and other assets.

The income and resource limits for food stamp eligibility vary depending on the size of the household and the state in which the household lives. In general, households with higher incomes and resources are not eligible for food stamps.

Income

- Wages, salaries, and tips

- Self-employment income

- Social Security benefits

- Supplemental Security Income (SSI)

- Unemployment benefits

- Workers’ compensation

- Child support

- Alimony

Resources

- Cash

- Bank accounts

- Stocks

- Bonds

- Mutual funds

- Real estate (other than the home you live in)

- Vehicles (other than one per household member)

Not all income and resources are counted when determining eligibility for food stamps. Some types of income, such as student loans and grants, are not counted. Some types of resources, such as retirement accounts and life insurance policies, are also not counted.

Household Size and Composition

Household size and composition significantly influence the amount of food stamp benefits received. Generally, larger households with more members qualify for higher benefit amounts. The composition of the household, including the presence of children, elderly individuals, or disabled members, may also affect eligibility and benefit levels.

Benefit Amounts Based on Household Size

The following table provides examples of household sizes and corresponding benefit amounts under the Supplemental Nutrition Assistance Program (SNAP):

| Household Size | Maximum Monthly Benefit (2023) |

|---|---|

| 1 | $281 |

| 2 | $516 |

| 3 | $740 |

| 4 | $954 |

| 5 | $1,152 |

| 6 | $1,340 |

| 7 | $1,528 |

| 8 | $1,716 |

Deductions and Expenses

Deductions and expenses are subtracted from income to determine food stamp eligibility. This helps ensure that individuals and families with limited resources have access to the assistance they need.

Common deductions and expenses include:

Standard Deduction

- A fixed amount that varies depending on household size and composition.

- Designed to account for basic living expenses.

Dependent Care Deduction

- Expenses paid for the care of a dependent, such as a child or elderly relative.

- To qualify, the care must allow a household member to work or attend school.

Shelter Expenses

- Rent, mortgage payments, property taxes, and homeowner’s insurance.

- These expenses can be deducted in full or partially, depending on the program guidelines.

Medical Expenses

- Out-of-pocket medical expenses, such as doctor’s visits, prescription drugs, and hospital stays.

- These expenses can only be deducted if they exceed a certain percentage of income.

Child Support Payments

- Payments made to support a child who does not live in the household.

- These payments are deducted from the income of the parent making the payments.

State Variations

Food stamp benefits can vary significantly from state to state. This is because each state has the flexibility to set its own benefit levels and eligibility criteria within federal guidelines.

The following table compares food stamp benefits in different states:

| State | Maximum Monthly Benefit | Income Eligibility Limit |

|---|---|---|

| Alabama | $200 | 130% of the federal poverty level |

| California | $500 | 200% of the federal poverty level |

| Florida | $300 | 150% of the federal poverty level |

| New York | $400 | 185% of the federal poverty level |

| Texas | $250 | 160% of the federal poverty level |

As you can see, the maximum monthly benefit can range from $200 to $500, and the income eligibility limit can range from 130% to 200% of the federal poverty level.

Other Factors

Apart from the previously mentioned aspects, other factors can influence the amount of food stamp benefits received. These include:

- Disability: Individuals with disabilities may qualify for additional benefits, as their condition may affect their ability to work or earn income.

- Unemployment: Unemployed individuals may also receive increased benefits, as they face challenges in obtaining sufficient income to meet their needs.

Summary

Determining SNAP eligibility and benefit amounts involves a thorough assessment of various factors. By understanding the criteria Artikeld in this guide, you can gain a clear understanding of why you may be receiving $20 in food stamps. Remember, the program is designed to provide supplemental support, and the amount you receive is intended to supplement your income and resources to ensure adequate nutrition.

FAQ Summary

Why am I only getting $20 in food stamps when my income is low?

SNAP benefits are calculated based on net income, which is your gross income minus certain deductions and expenses. If your net income is low, but your gross income is high, you may still have limited eligibility for SNAP.

How does household size affect SNAP benefits?

Household size is a significant factor in determining SNAP benefits. Larger households generally receive higher benefits to account for increased food needs.

What deductions can I claim to reduce my net income for SNAP eligibility?

Common deductions include child support payments, dependent care expenses, and medical expenses. By deducting these expenses from your gross income, you can potentially increase your SNAP benefits.

How do state variations impact SNAP benefits?

SNAP benefits can vary from state to state due to differences in cost of living and other factors. Some states may provide additional benefits or have different eligibility criteria.

What other factors can affect my SNAP benefits?

Factors such as disability or unemployment can impact your SNAP eligibility and benefit amount. These factors are considered to ensure that individuals with specific needs receive appropriate support.