The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides vital assistance to low-income individuals and families in meeting their nutritional needs. In Michigan, income limits determine eligibility for this essential program. Understanding these limits is crucial for those seeking assistance and for ensuring equitable distribution of resources.

This guide will delve into the income eligibility guidelines for food stamps in Michigan, considering household size, deductions, and asset limits. We will also explore the application process, program benefits, and regulations to provide a comprehensive overview of this important topic.

Income Eligibility

To qualify for food stamps in Michigan, households must meet certain income limits. Gross income is the total amount of money a household earns before any deductions or taxes. Net income is the amount of money left after deductions and taxes have been taken out.

The gross income limit for food stamps in Michigan is 130% of the federal poverty level. The net income limit is 100% of the federal poverty level. The federal poverty level is updated each year by the U.S. Department of Health and Human Services.

Gross Income

Gross income includes all sources of income, such as wages, salaries, tips, commissions, bonuses, self-employment income, Social Security benefits, Supplemental Security Income (SSI), and unemployment benefits.

Net Income

Net income is calculated by subtracting certain deductions from gross income. These deductions include:

- Federal and state income taxes

- Social Security taxes

- Medicare taxes

- Child support payments

- Alimony payments

Exclusions

Some types of income are excluded from the food stamp income limit. These exclusions include:

- Money received from the sale of a home

- Gifts

- Loans

- Grants

- Scholarships

Household Size and Composition

The size and composition of a household directly impact the income limits for food stamps in Michigan. Larger households generally have higher income limits than smaller households, as they require more resources to meet their needs.

In determining eligibility, the government considers both gross income and net income. Gross income refers to the total amount of money earned by all household members before any deductions. Net income, on the other hand, is the amount of money remaining after subtracting allowable deductions, such as taxes, Social Security, and certain work expenses.

Income Limits for Different Household Sizes

The following table provides the gross and net income limits for different household sizes in Michigan:

| Household Size | Gross Income Limit | Net Income Limit |

|---|---|---|

| 1 | $1,859 | $1,487 |

| 2 | $2,507 | $2,006 |

| 3 | $3,155 | $2,524 |

| 4 | $3,803 | $3,043 |

| 5 | $4,451 | $3,561 |

| 6 | $5,099 | $4,080 |

| 7 | $5,747 | $4,598 |

| 8 | $6,395 | $5,117 |

Asset Limits

Asset limits play a crucial role in determining food stamp eligibility. Assets refer to the financial resources an individual or household possesses, and they can impact the amount of food stamp benefits received.

For the Food Stamp Program, asset limits vary based on household size and composition. Households with higher incomes and more assets may have reduced food stamp benefits or may not qualify at all.

Countable and Non-Countable Assets

Not all assets are treated equally when determining food stamp eligibility. Some assets are considered “countable,” while others are “non-countable.”

- Countable Assets: These include cash, bank accounts, stocks, bonds, mutual funds, and other financial investments. The value of countable assets is used to calculate the household’s total asset value.

- Non-Countable Assets: These include the primary residence, one vehicle, household goods and personal belongings, and certain retirement accounts, such as 401(k)s and IRAs.

Determining Asset Values

To determine the value of countable assets, the Food Stamp Program uses the fair market value, which is the estimated price an asset could be sold for in the current market. The value of non-countable assets is not considered when determining food stamp eligibility.

Application Process

Applying for food stamps in Michigan involves a straightforward process. To initiate the application, you can opt for either an online or in-person submission. The online application can be accessed through the Michigan Department of Health and Human Services (MDHHS) website, while in-person applications are available at local MDHHS offices.

Required Documentation

During the application process, you will be required to provide specific documentation to verify your eligibility. These documents typically include:

- Proof of identity (e.g., driver’s license, state ID card)

- Proof of residency (e.g., utility bill, lease agreement)

- Proof of income (e.g., pay stubs, bank statements)

- Proof of resources (e.g., savings account statements, retirement accounts)

- Social Security numbers for all household members

Application Submission and Status Tracking

Once you have gathered the necessary documentation, you can submit your application online or in person. After submitting the application, you will receive a confirmation number for reference. You can track the status of your application by logging into your online account or contacting the MDHHS office where you applied.

The review and approval process typically takes 30 days or less, but it can vary depending on the complexity of your application.

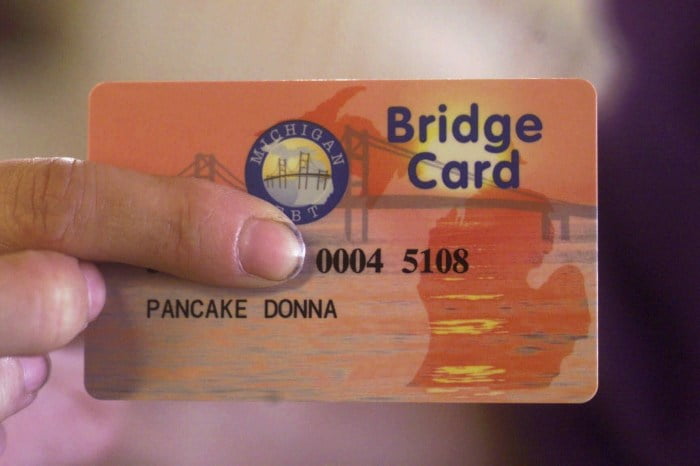

Program Benefits

The Food Stamp Program, now known as the Supplemental Nutrition Assistance Program (SNAP), provides financial assistance to low-income individuals and families to purchase food. This assistance is provided through monthly benefits that are loaded onto an Electronic Benefit Transfer (EBT) card.The

amount of benefits a household receives is based on several factors, including household size, income, and expenses. The USDA issues a Thrifty Food Plan (TFP) that establishes the minimum cost of a nutritionally adequate diet for different household sizes and ages.

SNAP benefits are calculated as a percentage of the TFP. The current benefit formula is:

Maximum SNAP Benefit = (TFP x 0.3)

- 30% x (Gross Monthly Income

- Standard Deduction)

SNAP benefits are distributed electronically through EBT cards. EBT cards can be used to purchase food at authorized retail stores. EBT cards cannot be used to purchase alcohol, tobacco, or other non-food items.

Program Regulations

To ensure the integrity of the food stamp program in Michigan, strict rules and regulations are in place. These guidelines govern how individuals can qualify for and utilize benefits.

Violating program rules can result in severe consequences, including disqualification from the program, repayment of benefits, and potential legal action.

Reporting Fraud or Abuse

If you suspect someone is committing fraud or abusing the food stamp program, you can report it to the Michigan Department of Health and Human Services (MDHHS) by calling 1-800-292-5463 or visiting their website at www.michigan.gov/mdhhs .

Closing Summary

In conclusion, the income limit for food stamps in Michigan is a crucial factor in determining eligibility for this vital program. Understanding the guidelines and considering household size, deductions, and asset limits is essential for successful applications. By providing assistance to low-income individuals and families, food stamps play a significant role in combating food insecurity and promoting the well-being of our communities.

Answers to Common Questions

What is the gross income limit for a single person household in Michigan?

The gross income limit for a single person household in Michigan is $1,835 per month.

What deductions are allowed from gross income?

Allowable deductions include: 20% of earned income, child support paid to non-household members, and certain medical expenses.

What is the asset limit for food stamps in Michigan?

The asset limit for food stamps in Michigan is $2,750 for a single person household and $4,250 for a household with two or more members.