In today’s economic climate, navigating the complexities of self-employment can be daunting, especially when it comes to qualifying for government assistance programs like food stamps. Determining self-employment income for food stamp eligibility requires careful calculations and an understanding of allowable deductions and expenses.

This guide will provide a comprehensive overview of the process, empowering you with the knowledge to accurately calculate your self-employment income and maximize your eligibility for food stamp benefits.

By delving into the nuances of income calculations, expense deductions, net income determination, reporting requirements, and available resources, this guide aims to simplify the process and equip you with the tools necessary to successfully navigate the food stamp application process as a self-employed individual.

Income calculations

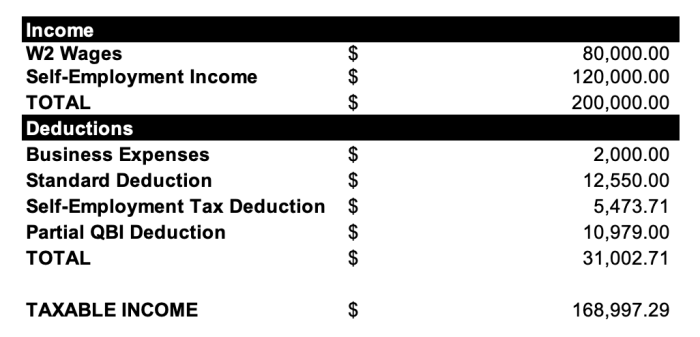

To determine self-employment income for food stamp eligibility, you must calculate your net income from self-employment. This includes all income from your business, minus allowable business expenses.

To calculate your net income from self-employment, follow these steps:

Step 1

- Add up all of your business income. This includes income from sales, fees, commissions, and other sources.

- Subtract all of your allowable business expenses. This includes expenses such as rent, utilities, supplies, and equipment.

- The difference between your business income and your business expenses is your net income from self-employment.

Types of Self-Employment Income

- Business income: This includes income from the sale of goods or services, as well as income from investments or other business activities.

- Farm income: This includes income from farming, ranching, or other agricultural activities.

- Rental income: This includes income from renting out property, such as apartments, houses, or land.

- Royalties: This includes income from patents, trademarks, or other intellectual property.

- Other self-employment income: This includes any other income that you earn from self-employment, such as income from freelance work or consulting.

Expense Deductions

Calculating self-employment income for food stamps involves identifying and deducting allowable expenses from your gross income. Understanding these deductions can help you accurately report your income and maximize your benefits.

The types of expenses that can be deducted from self-employment income include:

- Business expenses directly related to your self-employment activities, such as office supplies, rent, and utilities.

- Depreciation and amortization of business assets, such as equipment and vehicles.

- Home expenses, such as a portion of your mortgage or rent, utilities, and repairs, if you use part of your home for business purposes.

- Health insurance premiums paid for yourself and your family.

- Child care expenses if you have dependents who require care while you work.

To calculate these expenses, you need to maintain accurate records of all business-related expenses. This can include receipts, invoices, and bank statements. You should also keep a record of the percentage of your home that you use for business purposes.

Limits and Restrictions

There are certain limits and restrictions on expense deductions. For example, you can only deduct a portion of your home expenses if you use part of your home for business purposes. The percentage of your home that you can deduct is based on the amount of space that you use for business purposes.

Additionally, there are certain types of expenses that cannot be deducted, such as personal expenses, entertainment expenses, and expenses that are not ordinary and necessary for your business.

Net Income Determination

Determining net income is crucial for self-employed individuals applying for food stamps. Net income represents the amount of income left after deducting allowable expenses from gross income, and it directly impacts eligibility and benefit levels.

To calculate net self-employment income, subtract eligible business expenses from gross income. Gross income includes all earnings from self-employment, such as sales, fees, and commissions. Eligible expenses may include business-related costs like rent, utilities, supplies, and equipment depreciation.

Example Calculations

- Example 1: A freelance writer earns $5,000 in gross income. They deduct $1,000 in expenses, resulting in a net income of $4,000.

- Example 2: A self-employed contractor earns $10,000 in gross income. They have $3,000 in eligible expenses, resulting in a net income of $7,000.

Net income is essential because it determines the household’s financial resources. Food stamp eligibility and benefit amounts are based on household size, income, and assets. A lower net income may qualify a household for food stamps and higher benefit levels.

Reporting and Verification

Self-employment income must be reported to the food stamp agency on a regular basis, typically monthly or quarterly. The reporting requirements vary by state, so it’s important to check with your local agency for specific instructions. Generally, you’ll need to provide documentation of your income, such as invoices, bank statements, or tax returns.The

food stamp agency will verify your self-employment income through a variety of methods, including:

- Reviewing your business records

- Contacting your clients or customers

- Comparing your income to similar businesses in your area

Maintaining Records and Documentation

It’s important to maintain accurate records of your income and expenses for tax and food stamp purposes. These records should include:

- Invoices or receipts for all income

- Bank statements

- Tax returns

- Business expenses

- Mileage logs

Resources and Assistance

Understanding the complexities of self-employment income calculations for food stamps can be challenging. Fortunately, there are various resources available to help individuals navigate this process and maximize their benefits.

Local and State Agencies

Many local and state agencies offer assistance with food stamp applications and provide guidance on calculating self-employment income. These agencies can connect individuals with caseworkers who can provide personalized support and ensure accurate reporting.

Nonprofit Organizations

Numerous nonprofit organizations specialize in assisting individuals with food stamp applications and income calculations. These organizations often provide free or low-cost services, including:

- Walk-in assistance

- Telephone support

- Online resources

Online Tools

Several online tools can help individuals calculate their self-employment income for food stamps. These tools are typically easy to use and can provide instant estimates. However, it’s important to note that these tools may not be as comprehensive as working with a caseworker or nonprofit organization.

Last Recap

Calculating self-employment income for food stamps may seem like a complex task, but with the right guidance and understanding, it can be manageable. Remember, accurate calculations and proper documentation are key to maximizing your benefits. Utilize the resources available to you, seek assistance from organizations specializing in food stamp applications, and stay informed about any changes in regulations.

By following the steps Artikeld in this guide, you can confidently determine your self-employment income and ensure that you receive the support you need to meet your nutritional needs.

Common Queries

What types of income are considered self-employment income for food stamps?

Self-employment income includes earnings from businesses you own and operate, such as freelance work, consulting, or sole proprietorship income.

Can I deduct expenses from my self-employment income when calculating food stamp eligibility?

Yes, you can deduct certain business expenses from your gross income, such as advertising costs, rent, utilities, and equipment expenses.

How do I calculate my net self-employment income for food stamps?

Subtract your allowable business expenses from your gross self-employment income to determine your net income.

What documentation do I need to provide to verify my self-employment income for food stamps?

You may need to provide tax returns, business licenses, invoices, and receipts to verify your income.

Where can I get help with calculating my self-employment income for food stamps?

Contact your local food stamp agency or seek assistance from organizations that specialize in food stamp applications.